Td Bank Cd Rates

- Visit now to learn about TD Bank no fee CDs and find interest rate info, 6 months to 5 year terms, withdrawals & low $250 minimums. Find the right CD for you!

- Use the links below to access rates and details about deposit accounts currently offered by TD Bank. Savings/Money Market. Certificates of Deposit (CDs) Account Maintenance Information (opens new window) Fee Schedule (opens new window) Personal Deposit Account Agreement (opens new window) Important Information about TD.

- The best five-year CD rates tend to be much higher than the national average rate of 0.31% APY. These CDs can help you work toward your individual savings goals. These CDs can help you work toward.

- You want business CDs that earn interest at competitive rates and offer penalty-free access to funds. You want competitive business CD rates with a guaranteed return and a choice of terms. Minimum deposit.

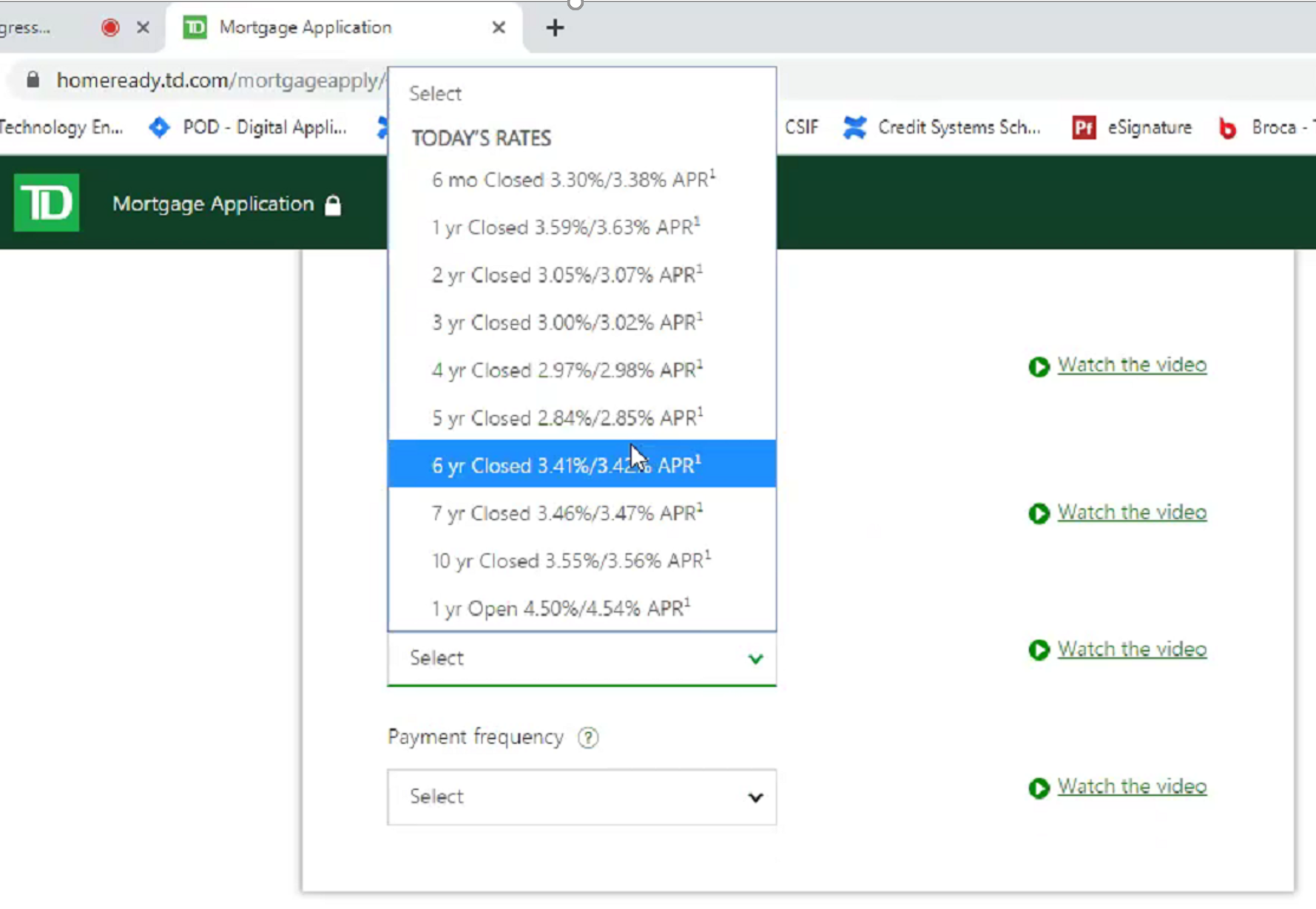

Not sure which certificate of deposit account is right for you? Read more about the benefits and features of each to help you decide.

You might also be interested in: |

Td Bank Savings

Chase offers standard rates and special rates for those customers who also have checking accounts with Chase or who maintain a certain balance. Let’s take a closer look at the.